In brief - Engaging early with the Commissioner of Taxation increases the prospect of resolving a dispute commercially and may avoid litigation. Nevertheless, be careful not to disclose documents that might waive privilege and seek legal advice.

So the ATO has got it wrong? We know that is what everyone thinks, but sometimes the ATO is right, and you owe them money. What you and what the ATO will do when the ATO thinks you owe money is guided by the ATO's enforcement principles.

The Commissioner has broad investigative and enforcement powers under the Taxation Administration Act 1953 (Cth) (TAA), Income Tax Assessment Act 1936 (Cth) and the Income Tax Assessment Act 1997 (Cth).

When the Commissioner makes a decision to commence an audit or to issue assessments, he does so according to internal policies, as well as the stated aims of the legislation that he is obliged to enforce. This is to promote fairness and transparency, while deterring taxation evasion and crime.

ATO internal dispute resolution policy and compliance model

If you are involved in a dispute with the Commissioner, it is important to be aware of the ATO's internal dispute resolution policies with a view to resolving the dispute outside of Court. This is particularly important considering the costs that are associated with litigation.

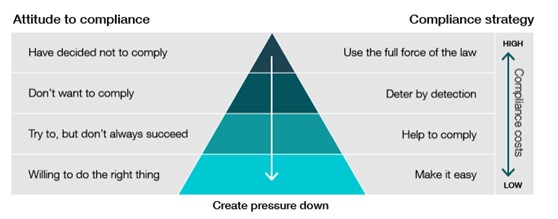

The ATO's compliance model and its stated policy in this area is summarised in the enforcement pyramid:

Whilst the model is not binding on the Commissioner in the same way as legislation, it does provide insight into the general approach in pursuing the taxpayer. It can easily be discerned that the Commissioner takes a more collegial approach with taxpayers who engage in the process willingly and at an early stage. It is also useful if you need to make submissions to the Commissioner.

The pyramid is enshrined in the Commissioner's disputes policy, which targets "early resolution at minimal cost". It is noted that "efforts to resolve disputes should be made as early as possible, including both before and throughout legal proceedings”.

By engaging with the Commissioner at an early stage you increase the prospect of resolving a dispute commercially and without being drawn into costly litigation.

Beware of inadvertently disclosing materials to the Commissioner

However, it is very important that when engaging with the Commissioner that you not inadvertently disclose documents or information that might waive privilege over documents that might later be used against you in litigation (such as advice from your lawyer).

Where privileged documents are disclosed the damage has been done and there is not an available cause of action to restrain the Commissioner from subsequently relying on the disclosed materials in later litigation. (See Glencore International Ag & Ors v Commissioner of Taxation & Ors [2019] HCA 26)

Whilst in some circumstances it is possible for the Court to make an order requiring the return of documents that have been inadvertently disclosed during Court ordered discovery (per Expense Reduction Analysts Group Pty Ltd v Armstrong Strategic Management and Marketing Pty Limited [2013] HCA 46), it does not prevent the Commissioner from obtaining them by way of some alternative means, for example under its information gathering powers in Schedule 1 Division 353 of the TAA.

Disclosure even of the "gist" or "conclusion"* of an advice could result in privilege to the advice and its underlying materials being compromised and the documents being ordered to be produced and subsequently relied on to your detriment in litigation.

Identifying what might and might not be properly considered as privileged is not straightforward and requires a consideration with the risks of future litigation always in mind. It is important to seek professional legal advice at an early stage.

Engaging with the Commissioner is more straightforward than you might think, but think like a zookeeper and do it with some caution.

* RCI Pty Ltd v Commissioner of Taxation of the Commonwealth of Australia [2009] FCA 910 at 47; Bennett v Chief Executive Officer of the Australian Customs Service (2004) 140 FCR 101 at [65].

This is commentary published by Colin Biggers & Paisley for general information purposes only. This should not be relied on as specific advice. You should seek your own legal and other advice for any question, or for any specific situation or proposal, before making any final decision. The content also is subject to change. A person listed may not be admitted as a lawyer in all States and Territories. © Colin Biggers & Paisley, Australia 2024.