In brief - We set out some considerations for AFS licensees and the insurance industry in light of CSLR legislation to implement the banking royal commission's recommendations expected to pass in 2022

The Treasury has issued an explanatory paper and draft legislation to implement the long-awaited Compensation Scheme of Last Resort (CSLR). The purpose of the scheme is to support confidence in the financial system's dispute resolution framework and deal with issues that have arisen where there have been failures of licensees and the relevant insurance is either inadequate or does not respond for various reasons.

Problems with claims against insurers when an AFSL is defunct

To comply with ASIC's Regulatory Guide 126, all AFSLs must have professional indemnity insurance.

It is often the case that the facts giving rise to a claim (eg a breach of duty) and the bringing of the claim do not occur in the same insurance policy year, and the latter may occur after the AFSL is insolvent.

Insurance policies would only respond pursuant to section 6 of the Law Reform (Miscellaneous Provisions) Act 1946 (NSW) if the fact giving rise to the claim and the claim were made in the same policy year, which rarely occurred in the case of claims made and notified policies (the only types of policies relevant to AFSL claims): Owners-Strata Plan 50530 v Walter Construction Group Ltd (in Liq) [2007] NSWCA 124

Reforms in, for example, NSW now allow direct claims against insurers: Civil Liability (Third Party Claims Against Insurers) Act 2017, as does section 562 of the Corporations Act 2001. The problem once again is that the insurer retains all of its indemnity defences, including where an AFSL has not given relevant notice to the insurer and then the policy expires.

It is clear that the attempt to rely upon required RG126 insurance has not been a perfect solution in all cases.

Ramsay Review's recommendations for a Compensation Scheme of Last Resort

In 2017, the Supplementary Final Report of the Review of the financial system external dispute resolution framework (Ramsay Review) made these three principal recommendations on the establishment of a CSLR:

-

establishing a CSLR that targets the areas of the financial sector with the greatest evidence of need;

-

a CSLR, if established, be initially restricted to personal financial advice failures but be scalable in the future to include other types of financial service as the evidence of uncompensated losses arise; and

-

a CSLR, if established, be established with particular design features, including that the scheme be prospective, ex-ante funded and accessible to consumers and small businesses.

Recommendation 7.1 of the Final Report of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry was that these three principal recommendations should be carried into effect.

What will be covered by the Compensation Scheme of Last Resort?

The financial products and services that are in-scope for the CSLR are those that are authorised to be provided by AFSL and Australian Credit Licence holders that are required by legislation to be Australian Financial Complaints Authority (AFCA) members.

The financial products and services that will not be within scope for the CSLR include those provided by a financial firm that is not required by legislation to be an AFCA member in respect of the provision of that service and those provided by voluntary AFCA members, such as small and medium enterprise credit.

The reason for not including financial products and services of voluntary AFCA members in the CSLR is that to include them would create a disincentive for voluntary AFCA membership and would add to CSLR complexity.

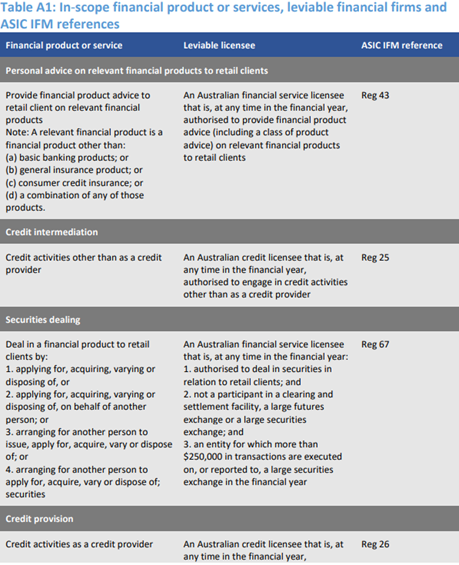

It is proposed that the CSLR will encompass:

Source: Compensation Scheme of Last Resort: Proposal Paper, Financial Services Royal Commission Recommendation 7.1, July 2021, page 31.

What is the process for CSLR claims?

The Treasury Report provides:

-

A CSLR claimant must notify AFCA that their Determination remains unpaid, or partially unpaid, within 12 months of the date of acceptance of the Determination.

-

After the claimant has notified AFCA that their Determination remains unpaid, AFCA will take reasonable steps to ensure the AFCA member pays the compensation owed.

-

AFCA is likely to:

-

Contact the AFCA member to seek an explanation of non-compliance;

-

Explain to the AFCA member the legal consequences of non-compliance;

-

Discuss a reasonable payment plan or other arrangement;

-

Engage with any insolvency practitioner appointed to an AFCA member that has become a Chapter 5 body corporate to determine whether the AFCA member can meet the requirements of the AFCA Determination; and

-

Take any other steps considered appropriate and cost-effective by AFCA to try to enforce the AFCA Determination or otherwise obtain compliance by the AFCA member.

CSLR compensation cap

It is proposed that the maximum compensation for each AFCA determination will be $150,000, which is similar to the UK's Financial Services Compensation Scheme's maximum of £85,000.

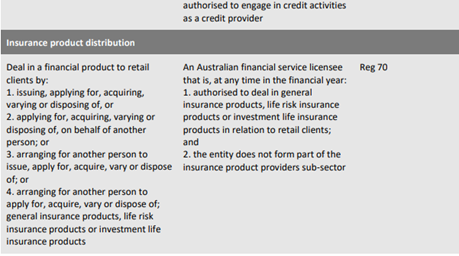

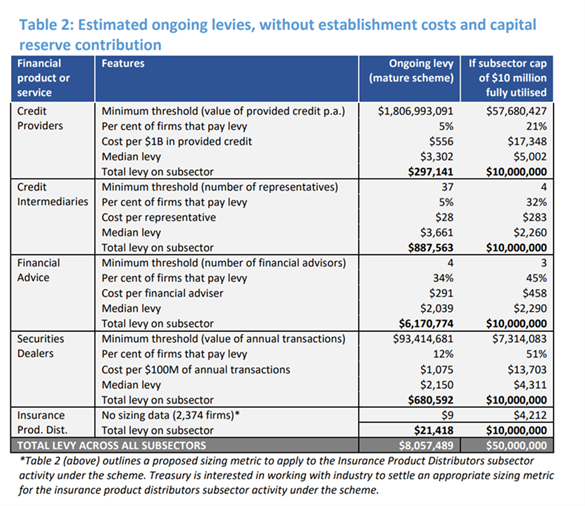

The scheme will be funded by a levy on the industry

Source: Compensation Scheme of Last Resort: Proposal Paper, Financial Services Royal Commission Recommendation 7.1, July 2021, page 19.

Source: Compensation Scheme of Last Resort: Proposal Paper, Financial Services Royal Commission Recommendation 7.1, July 2021, page 20.

Can or should an insurance scheme sit behind the CSLR as a pool?

The CSLR has a funding proposal but it is essentially a government insurance pool. Who will manage the pool and generate a return is an open question as it is unlikely that the smoothed fee stream will be sufficient to meet concentrations of collapses (and collapses tend to concentrate in a temporal framework as they are directly linked to economic externalities).

There is potential for an insurance pool to sit behind it. However, the issue with all insurance pools is structure and design, including:

-

Claims made in the relevant policy year must be covered with no prior known circumstances exclusion which means that the only way to make it viable would be via a compulsory pool or a Commonwealth entity reinsured by private insurers funded by compulsory premiums from all entrants, with no "underwriting";

-

There would need to be an appropriate incentive for private insurers to join such an arrangement - perhaps a guaranteed rate of return plus a variable performance rate, with one KPI being the shorter the time to resolve claims, the higher the variable rate factor, to avoid tactical declinatures;

-

If the Commonwealth insuring entity receives a running stream of premiums, there may be a prospect of securitisation. That might be a long-term investment incentive for the insurers - perhaps only insurers who participate are able to acquire the securitised bonds?

-

The big issue will be the run off period - how long does the notional policy respond for? AFCA has basically unlimited powers to extend limitation periods so it would have to be longer term - does the scheme perhaps have a longstop date?

-

Does the scheme get the right to "subrogate" ie recover from other bad actors? If so, how? For example, the S&L bailout in the US was highly profitable for the US government over time, and returned a positive rate, as the US government bad debt scheme took over the S&L's books and recovered over time.

CSLR implementation - timeline for the remainder of FY21 and for FY22

Consultation on the legislation is expected to take place in Q3 2021 and consultation on the regulations in Q4 2021. Legislation and regulations are expected to be passed and enacted in Q4 2021-Q1 2022.

Authorisation of the operator of the CSLR and when CSLR is expected to make its first payments to claimants are yet to be determined.

This is commentary published by Colin Biggers & Paisley for general information purposes only. This should not be relied on as specific advice. You should seek your own legal and other advice for any question, or for any specific situation or proposal, before making any final decision. The content also is subject to change. A person listed may not be admitted as a lawyer in all States and Territories. © Colin Biggers & Paisley, Australia 2024.