Snapshot of the Windfall Gains Tax

The WGT:

-

is payable by owners of land

-

applies if there is a change in zoning of the land that occurs on or after 1 July 2023

-

is imposed on the increase in the capital improved value of land that is attributable to the change in zoning

-

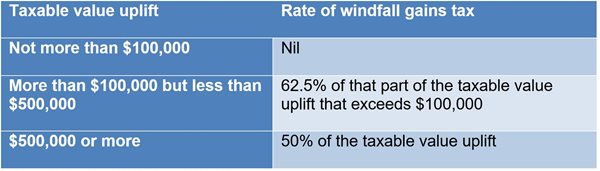

is imposed at the rate of 62.5% of uplifts between $100,000 and $500,000 and 50% for uplifts of $500,000 or more

-

is payable at the time that the change in zoning occurs or may be deferred with interest until the next dutiable transaction, subject to a 30-year limit

-

is not imposed on some changes in zoning, such as rezonings to public land zones, rezonings to and from the Growth Areas Infrastructure Contribution Area (GAIC Area) and changes within a zone

-

is not imposed on residential land of up to 2 hectares which includes a dwelling that is fit for occupation

-

is not payable by charities so long as the land continues to be used for charitable purposes for 15 years after the rezoning

-

is subject to transitional provisions for arrangements in place at 15 May 2021, which is the date that the WGT was announced by the government

-

is a first charge on the land.

Impact of the Windfall Gains Tax on developers, sellers, owners and charities

-

While the Bill contains some concessions that were not previously announced by the government, the WGT will add significant cost to development projects which will either be borne by sellers of development sites in the form of a lower sale price, or by developers. If the WGT is borne by developers, the cost will most likely be passed on to buyers of residential premises.

-

If the cost of the WGT is borne by sellers of development sites in the form of lower sale prices, that will reduce the market value of development sites across the board, which in turn will result in lower valuations of capital improved value and potentially more complex assessments of the WGT. More complex assessments of the WGT may lead to more disputes.

-

For many owners, the application of the WGT will be clear and the only grounds of objection to an assessment will relate to the valuation of the land that has been rezoned.

-

Parties entering into contracts for the sale and purchase of land will need to consider whether any of the terms shift liability for WGT from the seller to the buyer for a WGT event arising between the contract date and settlement. For example, the provision in the general conditions of contract which makes the buyer responsible for any notice, order, demand or levy imposing liability on the property may apply to WGT.

-

Alternatively, if the seller permits the buyer to take steps to rezone the land before completion, then the contract needs to clearly allocate liability for WGT.

-

Parties that have entered into an option before 15 May 2021 will need to take care that they do not do anything that causes the contract terms for the sale of the land not to have been settled, such as an amendment to the contract.

-

Liability to pay deferred WGT and interest may be inadvertently triggered by a transaction that is not subject to transfer duty because an exemption applies, but is otherwise a dutiable transaction. Liability may also be triggered by a transaction that has nominal consideration, or by a transaction that has no monetary consideration but has non-monetary consideration. Internal restructures require particular care.

-

The assessment of WGT may be complex where a WGT event occurs to land owned by different related entities, particularly where one or more of the entities is the trustee of a discretionary trust.

-

Charities may become liable to pay WGT if there is any change in use or occupation of the land.

-

The transitional arrangements for rezonings only apply if the owner has applied for the rezoning so a rezoning that occurs at the instigation of government or a third party does not qualify.

Windfall Gains Tax in detail

Assessment of WGT

The WGT is imposed on a WGT event.

A WGT event is a rezoning (which is an amendment of a planning scheme that causes land to be in a different zone than it was in before the amendment) other than:

-

a rezoning between schedules in the same zone

-

a rezoning that causes land to be included in the GAIC Area

-

the first rezoning after 1 July 2023 of land that was in the GAIC Area

-

a rezoning that causes land that was not in a public land zone to be in a public land zone

-

a rezoning that causes land that was in a public land zone to be in a different public land zone.

The above rezonings are called excluded rezonings. The Treasurer can add to the excluded rezonings by notice published in the Government Gazette.

The WGT is payable by the owner of the land, which is the registered proprietor of the land or the holder of the freehold interest in the land.

The WGT is payable when the WGT event occurs, which is when the rezoning takes effect under the Planning and Environment Act 1987, subject to deferral which is considered below.

Rate of Windfall Gains Tax

The taxable value uplift is the value uplift of the land less any deductions prescribed in the regulations. The regulations are not available and there is no indication from the government that there is any proposal to include any deductions in the regulations.

The value uplift is the difference between the capital improved value of the land attributable to the rezoning. The capital improved value is the price that the land could be sold on the open market assuming that it was a freehold interest that was not encumbered by any lease, mortgage or other charge.

The valuation process is slightly different for land which has been valued for rating or levy purposes and other land.

If land has been valued for rating or levy purposes, the most recent valuation in force before the WGT event is the base valuation. If a WGT event occurs, the Commissioner can ask the valuer-general to undertake a supplementary valuation of the land. That valuation must assess the value of the land at the same date as the base valuation was made, but on the assumption that the land had been rezoned. The value uplift is the difference between the value in the supplementary valuation and the value in the base valuation.

If the land has not been valued for rating or levy purposes, then the Commissioner can ask the valuer-general to undertake the valuations. The valuer-general may nominate another valuer. One valuation must be undertaken ignoring the effect of the WGT event and the other valuation must include the effect of the WGT event. The difference between the two valuations is the value uplift of the land.

There are provisions which enable the value uplift of the land to be determined where the land consists of separate occupancies that have been separately valued or where the land has not been separately valued. For separate occupancies, the valuations can be combined. For land that has not been separately valued, the value uplift is determined on an area basis.

If the owner holds more than one parcel of land that is subject to the WGT event, the WGT is assessed on the aggregated taxable value uplift and then apportioned to each parcel. Any negative taxable value uplifts are ignored.

There are grouping provisions which apply if a WGT event occurs to land that is held by different group members. Each group member is jointly and severally liable to pay the WGT. The composition of the groups is determined by rules which adopt familiar concepts of control.

For companies, those concepts are control of the composition of the board, ability to cast more than 50% of the votes or holding more than 50% of the issued share capital.

For trusts, it is the ability to control the appointment of the trustee or the right to more than 50% of the income or capital of the trust. The Commissioner is given power to determine that a person has the right to more than 50% of the income or capital of a discretionary trust.

Deferral of Windfall Gains Tax

An owner can elect to defer payment of all or part of the WGT before the day on which the WGT is payable. If deferral only relates to part of the WGT, failure to pay the WGT that is not deferred by the due date causes the whole of the WGT to become payable.

The deferred WGT becomes payable on the first of:

-

a dutiable transaction occurring in relation to the land, other than an excluded dutiable transaction

-

a relevant acquisition occurring in relation to a landholder who is the owner of the land, other than an excluded relevant acquisition

-

30 years after the WGT event.

Interest is payable on the amount of deferred WGT at the Treasury Corporation of Victoria 10-year bond rate.

The excluded dutiable transactions that do not cause the deferred WGT to become payable are the acquisition of an economic entitlement in relation to the land under the economic entitlement provisions, the registration of the legal personal representative of a deceased owner as the owner of the land, certain dutiable transactions for no consideration and certain dutiable transactions between charities.

For no consideration and charity transactions to be excluded, the new owner of the land must elect to assume the liability to pay the deferred WGT and any accrued interest on or before the date of completion of the transaction. The new owner must pay the deferred WGT and interest when it is due.

It will not be easy for a transaction to qualify as a no consideration transaction because the definition of consideration for stamp duty purposes has been applied and that definition has a very wide meaning.

The excluded relevant acquisitions are those which arise from:

If land is subdivided, the deferred WGT is allocated to the individual lots on an area basis.

Charitable land

WGT and interest is waived for charitable land if the land has remained as charitable land continuously for 15 years after the occurrence of the WGT event. If only part of the land has remained as charitable land for this period, then there is a partial waiver.

Charitable land is land that is owned by a charity and used and occupied by a charity exclusively for charitable purposes. Any use or occupation of the land that is not for charitable purposes, no matter how minor, may cause the land not to be charitable land.

Residential land exemption

WGT is not imposed on residential land that does not exceed 2 hectares if the land is the only residential land owned by the owner that is rezoned by a WGT event. If the land exceeds 2 hectares, there is a reduction in the taxable value uplift determined on an area basis.

The definition of residential land has many elements, so determining whether land is residential land is not straight forward in some cases. Generally, land is residential land if it has a building that in the Commissioner's opinion is designed and constructed primarily for residential purposes and may lawfully be used as a residence. Residential land can also include land where the residence is under construction or renovation.

Land other than land used for primary production cannot be residential land unless the Commissioner is satisfied that the land is used primarily for residential purposes. This means that land whose primary use is primary production can be residential land if it has a residence on it. Adjoining primary production land on a separate title that does not have a residence on it is not residential land.

Land that is capable of being used and occupied solely or primarily as commercial residential premises, residential care facilities, supported residential services and retirement village services is not residential land, unless the residence is separately owned and held on a separate title. The Bill contains definitions of each of these concepts.

Transitional arrangements

There are two transitional provisions.

The first relates to contracts and options entered into before 15 May 2021. WGT is not imposed if the land is subject to:

-

a contract of sale entered into before 15 May 2021 that has not been completed before the WGT event occurs

-

an option granted before 15 May 2021 that either has not been exercised before the WGT event occurs, or has been exercised and the contract has not been completed before the WGT event occurs, provided that the terms of the contract were settled at the time the option was granted.

The second relates to rezonings that were commenced by the owner and significantly progressed before 15 May 2021.

If the rezoning is pursued through a local council, WGT is not imposed if the Commissioner is satisfied that before 15 May 2021 the owner requested the amendment, the request was created and registered in the Amendment Tracking System by the council and the owner has incurred or was liable to incur costs or perform works above a threshold amount. The threshold amount is the lesser of 1% of the capital improved value of the land immediately before the WGT event or $100,000.

There are similar provisions for rezonings pursued with the Planning Minister.

Exemption for rezoning errors

WGT is not imposed if the WGT event arises from an amendment to correct an obvious or technical error in the Victoria Planning Provisions.

If the amendment results in a negative value uplift to land on which WGT has been previously assessed, the owner is entitled to a refund of any WGT and interest if it was the owner of the land at the time of the original WGT event.