In brief - Increased compliance costs fall mainly on purchasers

Schedule 2 of the Tax and Superannuation Laws Amendment (2015 Measures No. 6) Bill 2015, which will come into effect on 1 July 2016, aims to improve compliance with Australia's foreign resident capital gains tax (CGT) regime. However, there are concerns that the proposed tax measure, which requires the purchaser to withhold and pay 10% of the sale proceeds of taxable Australian property to the Australian Taxation Office (ATO), will not just adversely affect purchasers, but vendors and the property market as well.

ATO wants better foreign resident compliance with CGT regime

The previous government announced on 14 May 2013 that it would introduce a 10% non-final withholding tax on payments made by foreign residents that dispose of certain taxable Australian property. The current government introduced a Bill for this measure into Parliament on 3 December 2015.

This Bill introduces amendments to Australia's taxation laws to improve the operation of Australia's CGT regime. The measures in this Bill are two of the 92 announced but un-enacted measures left by the previous government. Schedule 2 of this Bill introduces a new collection mechanism to support the operation of Australia's foreign resident CGT regime.

The ATO has indicated that voluntary compliance with Australia's foreign resident CGT regime has been poor. In the new regime, when a foreign resident disposes of a certain taxable Australian property, the purchaser will be required to withhold and pay to the ATO 10% of the proceeds from the sale. The purpose of the regime is to assist in the collection of foreign residents' CGT liabilities.

The proposed tax measure may impede the smooth operation of transactions in the property market and has the potential to disrupt the property market significantly. There is a concern that the proposed tax measure will give rise to additional significant compliance costs for all parties to a transaction and may burden a purchaser with serious penalties where the liability to pay any CGT should be a matter for the vendor.

Real property, mining and indirect interests to be affected by amendments

This withholding tax is limited to these types of taxable Australian property:

- real property situated in Australia (including a lease of land situated in Australia) - land, buildings, residential and commercial property

- mining, quarrying or prospecting rights, if the minerals, petroleum or quarry materials are situated in Australia

- interests in Australian entities that predominantly have such assets (called indirect interests)

Foreign resident vendors' exclusions negate need to withhold 10%

If the foreign resident vendor falls within one of these exclusion categories, then there is no obligation to withhold the 10%:

- Taxable Australian Real Property (TARP) transactions valued under $2 million

- transactions that are conducted through a stock exchange

- an arrangement that is already subject to an existing withholding obligation

- a securities lending arrangement

- the foreign resident vendor is under external administration or in bankruptcy

Australian residency for tax purposes defined

A "foreign resident" means a person who is not a resident of Australia for the purposes of the Income Tax Assessment Act 1936.

An individual is generally an Australian resident if they reside in Australia. They will also be considered an Australian resident if they are domiciled in Australia, or are present in Australia for at least 183 days of the income year.

A company is a resident of Australia if it is incorporated in Australia, if it carries on a business in Australia and has either its central management and control in Australia, or its voting power is controlled by shareholders who are Australian residents.

Onus is on vendor to apply for clearance certificate

The ATO may certify that, based on the information supplied to the ATO, there is nothing to suggest that an entity is or will be a foreign resident during a specific period. The purchaser is entitled to rely on the clearance certificate and would not be required to pay an amount to the ATO.

This means Australian resident vendors will be required to apply for a clearance certificate to ensure that no funds are withheld from the sale proceeds. The vendor may apply for a clearance certificate at any time. This can be before the property is listed for sale and is valid for 12 months.

If the vendor fails to provide the clearance certificate by settlement, the purchaser must withhold 10% of the purchase price and pay this to the ATO on the day of settlement.

Example 1 (From the Tax and Superannuation laws Amendment (2015 Measures no. 6) Bill 2015 Explanatory Memorandum p.53):

Louis purchases real estate in Melbourne from Lucas for $3 million. Although Louis believes that Lucas is an Australian resident, unless Lucas provides Louis with a clearance certificate from the Commissioner/ATO, Lucas will be considered a relevant foreign resident. Louis would need to make a withholding payment to the ATO under the new Law.

Example 2 (Ibid., p.53):

Jane plans to sell a piece of real estate in Sydney to John for $4 million. Because Jane knows that she is a foreign resident at the time the transaction is entered into, she does not apply for a certificate from the ATO. In the absence of a certificate, Jane will be considered a relevant foreign resident for the purposes of the amendments. John is required to make a withholding payment to the ATO under the new law.

Diagram 1 (Ibid., p.51):

Are you dealing with a relevant foreign resident?

"Knowledge condition" is a reasonable grounds test on accepting the vendor's residency

The knowledge condition is only relevant to acquisitions of indirect Australian real property interests and options and rights to acquire TARP or indirect Australian real property interests. It is not relevant to TARP and indirect interests that constitute company title interests, where the clearance certificate process applies.

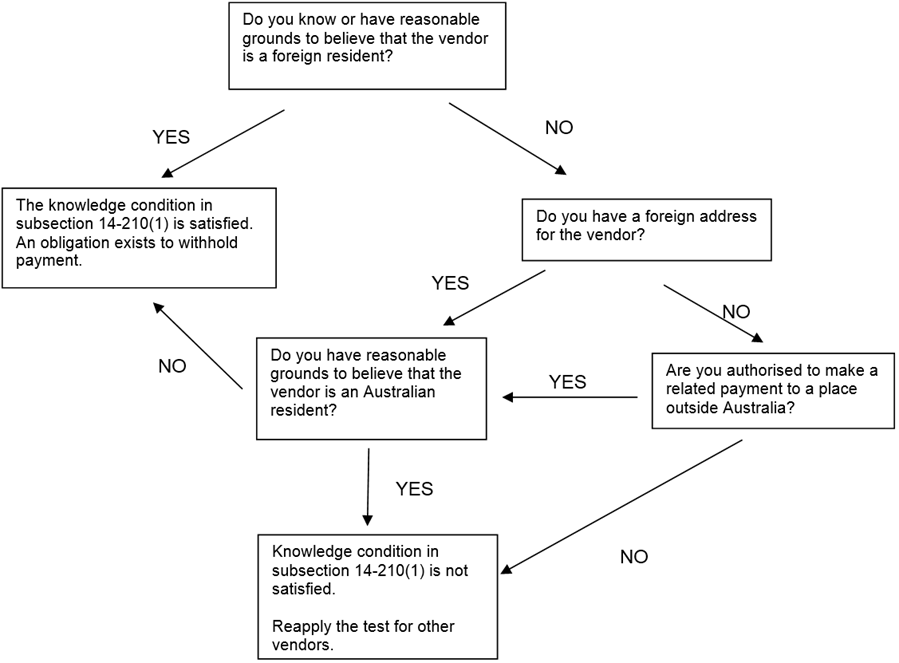

Diagram 2 (Ibid., p.56): The Knowledge Condition

Example 3 (Ibid., pp.57-58):

Andrew enters into an off-market transaction to acquire all of the shares in a company. The majority of the company's investments are in real property holdings throughout Australia. The shares, therefore, constitute indirect Australian real property interests. Andrew does not know the vendors of the shares. Under the terms of the sale contract, Andrew is to transfer the purchase price of the shares to an overseas bank account in the name of an associate of the vendor.

At this stage, the knowledge condition in subsection 14-210(1) is satisfied. Andrew notifies the vendor that he intends to withhold a portion of the purchase price unless the vendor can provide Andrew with further information about his residency.

The vendor provides Andrew with a declaration that states that the vendor is an Australian resident for income tax purposes, which Andrew does not know to be false. The knowledge condition is no longer satisfied because Andrew has a declaration that the vendor is an Australian resident, that he is entitled to rely on.

Even if Andrew could not verify the declaration to the extent necessary for him to have a reasonable belief in its accuracy, he could rely on it and no payment obligation would arise.

Purchasers' obligations to the ATO and variation of withholding amounts

A purchaser must pay 10% of the first element of the cost base for the CGT asset. This will usually be the total consideration they paid, or are required to pay, to acquire the CGT asset.

Both vendor or purchaser may apply to the ATO for a variation of the amount to be withheld. Reasons for a variation could include that:

- the foreign resident will not make a capital gain on the transaction

- the foreign resident will otherwise not have an income tax liability

- there are multiple vendors, only one of which is a foreign resident

Example 4 (Ibid., p.60):

Victor is a foreign resident who is selling a commercial property with a cost base of $3 million. Victor does not expect to be able to sell the property for $3 million or more (i.e. he expects to make a capital loss on the sale).

Victor applies to the Commissioner/ATO for a variation. The ATO issues a variation notice to Victor stating that the amount payable to the ATO, by a purchaser of Victor's property is reduced to nil. The variation is subject to the condition that the purchase price for the property does not exceed $3 million.

Later Paul agrees to purchase the property from Victor for $2.9 million. Victor provides a copy of the variation notice to Paul. The variation takes effect and Paul's liability to the Commissioner is reduced to nil.

A creditor of the vendor may have a security interest over an asset that is subject to the amendments. There may be situations in which the proceeds of the sale are insufficient to cover both the amount to be paid to the ATO and to discharge the debt the loan secures. Thus, a secured or unsecured creditor may apply to the ATO for a variation.

Example 5 (Ibid., p.61):

Chris, a foreign resident, owns a commercial property located in Australia. Chris owes $3 million to a bank, which is secured by a mortgage over the commercial property. Chris' business has been performing poorly and he has missed a number of repayments on the loan. The bank decides to exercise its power of sale.

The property is sold for $2.9 million net of costs. The proceeds are insufficient to pay the Commissioner and discharge Chris' mortgage.

Chris would prefer that the ATO is paid in preference to the bank because he would be entited to a credit for this amount. Therefore, he does not apply for a variation.

The bank is entitled to apply for a variation and does so. The ATO considers the circumstances and concludes that requiring an amount to be paid to the ATO would prevent the bank from recovering the debt from its secured interest.

The ATO issues a notice to the bank that varies the amount to nil. The bank provides a copy of notice to the purchaser, the purchaser is then relieved of any obligation to pay an amount to the ATO.

Exercising option to buy property attracts special rule

Where a purchaser's acquisition of property is the result of the exercise of an option, a special rule applies to avoid double counting. Where a purchaser is required to withhold, the amount to which the 10% is applied is reduced by any payments the purchaser made for the option. It is also reduced by the market value of any property the purchaser gave for, or to renew or extend the option.

Penalties apply for failing to withhold required amount

The required amount must be paid to the ATO on or before the day the purchaser becomes the owner of the property. This is to be distinguished from the time the purchaser is taken to have acquired the asset for CGT purposes. The penalty for failing to withhold is equal to the amount that was required to be withheld and paid.

Where an amount is withheld, the purchaser is required to complete a "Purchaser Remittance Form" and to provide the ATO with details of the vendor, purchaser and the asset acquired.

Tax changes are sweeping, but are they proportionate?

The amendments made in the Bill will have a huge impact and will create a burden on many people. It is difficult to justify such a massive overhaul of the system by the current revenue leakage from unpaid foreign resident CGT.

This is commentary published by Colin Biggers & Paisley for general information purposes only. This should not be relied on as specific advice. You should seek your own legal and other advice for any question, or for any specific situation or proposal, before making any final decision. The content also is subject to change. A person listed may not be admitted as a lawyer in all States and Territories. © Colin Biggers & Paisley, Australia 2024.