In brief - Australian market offers opportunities for student accommodation providers

Although Australia's universities continue to attract international students, there is a serious shortage of student accommodation in Melbourne, Sydney and Brisbane. Developers may be reluctant to invest in this market, preferring quick profits from residential development, but governments are showing signs that they are willing to offer financial incentives. While further investment is imminent, governments will need to do more.

Australia ranks high as education destination but lacks student accommodation

Education remains a constant cornerstone of the Australian export market, epitomised by recent Department of Education research that ranks Australia as the fifth most popular place in the world to study. This international demand for tertiary education does not appear to be waning, with the Department forecasting a 30% increase in international students by the year 2020.

This quickly raises questions as to where these students will live. University students who aren’t living "at home" or in their own rented properties, may reside in either commercial Purpose Built Student Accommodation (PBSA), or provisions the university sets out itself, usually on campus. Growth, however, originates from commercial PBSA, which already supplies far more beds than the universities.

The reputable QS World University Rankings ranks five Australian universities in the top 50, including the Australian National University, Melbourne University, the University of Queensland, the University of NSW and Sydney University. It is therefore unsurprising that the Department found that three-quarters of students study on the Eastern seaboard, indicating that the active markets are capital cities along the East Coast.

The shortage of student accommodation in these cities is so prevalent that real estate group JLL expressed, in its recent Australian Student Accommodation Market Update 2015, that even with pipeline development, total supply would be at 9.08%, 10.26% and 13.65% in Melbourne, Sydney and Brisbane respectively. This paints a crystal-clear picture of the student accommodation shortage, as the market is already starting behind and is projected never to catch up.

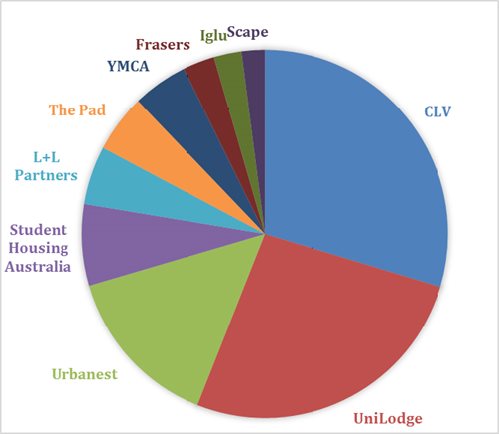

Top ten student bed providers rapidly growing market share

There have been a number of large developments in 2015, including the Urbanest Central and UniLodge at Central Park in Sydney and the Urbanest development on La Trobe Street, Melbourne. These providers in particular are big players in the private student accommodation market, only topped by accommodation provider CLV. According to the JLL Market Update, these top three providers are followed by Student Housing Australia, Living + Learning Partners, The Pad, YMCA, Frasers, Iglu and Scape in order of number of beds owned or managed.

These top 10 providers are rapidly growing their share in the market with data showing that their total number of beds increased by 9% in the last 12 months. This still does not account for their 13 buildings in the pipeline, which will balloon their total combined number of operational beds to 37,068.

Figure 1: Share of total operational and pipeline beds as at February 2015

(Source: JLL Australian Student Accommodation Market Update 2015)

Market sees increase in large financial commitments and partnerships

The market is not stagnant, however, and the increased interest in the market has sparked large financial commitments and partnerships, such as:

- British accommodation provider Scape will develop a $400 million student accommodation precinct backed by Dutch pension fund APG

- Relatively new operator Living + Learning Partners is led by another British provider in Balfour Beaty

- A two-stage $55 million development in Brisbane’s south is already underway with the backing of Singapore giant Wee Hur Holdings

- Other notable investors in the market include Singapore wealth fund GIC and Macquarie Capital

This indicates the sheer volume of finance being injected into the market, which demonstrates the potential profits in the eyes of commercial providers. Or maybe they simply have too much money to invest. Only time will tell which is the case.

Residential development often seen as a more attractive investment

In evaluating the opportunity for student accommodation development, it is important to recall the objective of a long-term high yield as opposed to the relative "snatch-and-grab" of residential development. This yield relies on student demand, which is dictated by the affordability of the city itself. This can ebb and flow with:

- the Australian dollar

- students’ willingness to pay

- potential rental inflation

For a developer to commit to student accommodation, the positive signs in these three criteria must outweigh other feasible development options, particularly residential development. While the real estate market is hot, these three considerations pale in comparison to the potential residential profits. Thus, those looking to use the land for PBSA are outbid by buoyant residential developers.

A further barrier to entry is the intimidation of an unknown market. JLL’s director of student accommodation, Conal Newland, underlines the importance of market knowledge. He indicates that while there are international players and investors willing to make financial commitments, they would rather acquire experience from local operators through partnerships.

Supply of student accommodation in London significantly higher

The London student accommodation market is a fair comparison. Home to many of the world’s premium tertiary education institutions, it is an international student hub. According to JLL data, it boasts a 27% supply of accommodation to total full-time students, an enormous difference from the aforementioned 9.08% in Melbourne. Interestingly, university provisions accommodate 18% of London’s full-time students, which is a stark contrast to Melbourne again, where university provisions only cover 2.4% of full-time students. This data suggests that the market for PBSA in Australia is even stronger than in London due to a smaller supply and a lower level of provision from universities.

The London student accommodation market is still experiencing a shortage and providers are investing heavily, with JLL predicting total transactions to exceed £5 billion by the end of the year.

Governments increasingly willing to assist student accommodation providers

With residential developers outgunning student accommodation providers and the gap between beds provided and students needing them continuing to grow, it is unlikely that the market will right itself in the short term. However, governments have exhibited their willingness to assist student accommodation providers to overcome this barrier to entry. For example, the Brisbane City Council has already committed to a $13,440 discount on infrastructure and utilities charges for every student accommodation unit built within a certain radius of the CBD. Brisbane has a great deal of accommodation in the pipeline, so this incentive may very well bear fruit. However, only time will tell the quantifiable effects on the market.

One can only assume that the future lies in zoning restrictions, essentially carving out areas of land in CBD areas explicitly for student accommodation development. This will enable providers to have access to prime real estate without competing with a buoyant residential market. The actions of Brisbane City Council suggest that governments are not oblivious to the shortage and are willing to take steps to see it addressed.

Market offers great potential for student accommodation developers

While it is unlikely that our cities will all become student havens, it is imminent that the number of large-scale transactions and developments in the pipeline will grow.

In a February 2014 interview with the Australian Financial Review, the director of student accommodation provider Iglu spoke frankly about the simplicity of the equation: “The increase in student numbers has not been met with an equivalent increase in suitable accommodation supply.” For this reason, there is a great deal of potential. A careful read of the market could result in a highly profitable student accommodation development which may even reap further benefits with government assistance.

This is commentary published by Colin Biggers & Paisley for general information purposes only. This should not be relied on as specific advice. You should seek your own legal and other advice for any question, or for any specific situation or proposal, before making any final decision. The content also is subject to change. A person listed may not be admitted as a lawyer in all States and Territories. © Colin Biggers & Paisley, Australia 2024.