Victoria's abolition of stamp duty for commercial and industrial properties

By Michael Lanyon, Amy Liu and Shyan Sivaratnam

On 19 March 2024, the Victorian government introduced the Commercial and Industrial Property Tax Reform Bill 2024 which will see stamp duty on commercial and industrial properties replaced with a new annual property tax.

In brief

On 19 March 2024, the Victorian government introduced the Commercial and Industrial Property Tax Reform Bill 2024 which will see stamp duty on commercial and industrial properties replaced with a new annual property tax.

Background

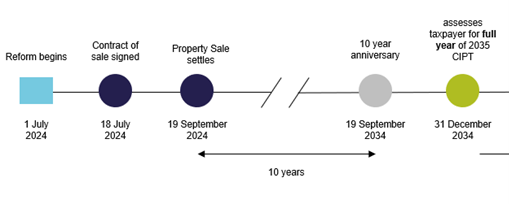

From 1 July 2024, Victoria will be replacing stamp duty on commercial and industrial property, with a new annual commercial and industrial property tax (CIPT). This regime was first announced in the May 2023-2024 budget, and is a welcome change to incentivise businesses to invest in commercial and industrial buildings and infrastructure, by removing the significant upfront stamp duty cost.

For commercial and industrial property purchased after 1 July 2024, the owner will upon settlement:

-

Stamp duty: Pay the final stamp duty either as (i) a upfront lump sum payment or (ii) 10 annual instalments under a government transition loan - equivalent to upfront stamp duty plus interest.

-

CIPT: Pay the annual CIPT 10 years after the transaction i.e. 1 July 2034 under a government facilitated loan.

The CIPT will be set at a flat 1% of the unimproved value of the land. However, the rate of CIPT for build-to-rent land will be 0.5% of the taxable value of the land, in line with build to rent land tax concessions.

See example of the operation of the regime below.

Eligibility requirement

A property will enter the regime if the following conditions are satisfied: qualifying dutiable transaction (transfer of land), has qualifying interest

-

qualifying dutiable transaction being transaction for the sale, transfer, consolidation or subdivision of the property occurs on or after 1 July 2024;

This includes any direct sale of the property or indirect sale of shares or units in an entity that owns the property (i.e. 50% acquisition in company or 20% interest in private trust).

-

qualifying interest being 50% or more of the property transacts.

This includes aggregation of certain associated transactions when

-

transferee under each dutiable transaction is the same person, and the dutiable transaction are entered into within 12 months; or

-

the transferees are associated persons if the dutiable transaction occur within a 3 year period.

-

it has a qualifying commercial and industrial use on the date of the transaction

The property must be coded by the Valuer General as commercial, industrial, extractive industries or infrastructure and utilities property, recorded on the land tax assessments, or a qualifying student accommodation. A qualifying student accommodation is land used solely or primarily as commercial residential premise (with the same definition as the GST Act), and for providing accommodation to tertiary students.

For mixed use property, the Commissioner will undertake a sole or primary use test, determined on various factors such as floor area, economic and financial significance of each use of the property determined on a case by case basis;

-

it is not an excluded transaction, such as transactions exempt from stamp duty e.g. deceased estate or transfer between spouses, or corporate reconstruction or consolidation relief.

Important considerations

1. Interaction with other taxes

CIPT will apply in addition to any land tax payable and windfall gains tax. There will be no surcharge on the CIPT for any acquisition of commercial and industrial properties by foreign persons.

It is also important to note the interaction of CIPT with landholder duty. The CIPT regime applies to any indirect landholder acquisitions. Landholder duty is payable on acquiring 50% or more of the shares in a private company, or 20% or more of the units in a private unit trust that owns land. The are complex tracing rules, change of corporate structure up the chain can result in landholder duty being payable as well as the CIPT implications to be considered as part of the due diligence;

2. Subsequent sale

Any subsequent transaction in respect of land under the CIPT will not be subject to stamp duty, and the subsequent owner be liable for the annual CIPT after the 10 year transitional period if:

-

the original transaction which brought the land into the CIPT regime related to 100% of the land; or

-

the subsequent transaction occurs at least 3 years after the original transaction. Accordingly, if it advisable for the subsequent purchaser to purchase the land at least 3 years after the original sale, if they are purchasing less than 100% of the land.

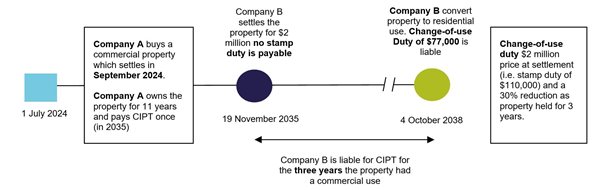

3. New change of use duty

There is an obligation to notify the Commissioner within 30 days of the change of use, and there will be penalty for failure to notify within this timeframe.

If the property that is within the scheme changes to a non-qualifying use (e.g. residential purpose), a change of use duty would apply.

The property owner will not be liable for the CIPT that year, but the property owner will be liable for a change of use duty on sale, calculated based on the stamp duty that would have been payable when the property was last transacted prior to its change in use, discounted by 10 per cent for each year the transaction where the property owner would have paid the CIPT.

4. Transitional loan

Broadly, this loan regime is available to Australian purchasers who are approved for finance from an authorised deposit-taking institution or another approved lender. The maximum purchase price of the land that is eligible for the loan will be $30 million.

The Treasury Corporation of Victoria will have a first ranking charge which will be registered on title. Property owners need to be conscious of how this charge affects their ability to obtain further finances, and interacts with the priority of bank securities.

The loan must be repaid before the property is transferred to a subsequent purchaser. The loan will not be able to be novated or transferred to a subsequent purchaser.

5. Property transaction implications

Issues clients will need to consider include:

Should a client enter into contracts before 1 July 2024?

What if options have already been signed which are exercisable after 1 July 2024?

How will the CIPT affect stamp duty and land tax?

Who are the winners and losers in this change?

Information on whether the property is subject to CIPT regime, including the amount of any outstanding CIPT will be included on a Property Clearance Certificate issued by Victorian State Revenue Office.

What's next?

Victorian property investors looking to purchase commercial and industrial property, should consider whether to elect for upfront payment or 10-year loan scheme. Property investors may be required to undertake a detailed quantitative cost benefit analysis of the two options, taking into account their project plan and anticipated future use of the property.

Property investors should pay particular attention if the property is subject to potential change of use, for example any industrial warehouse that was later developed into residential apartments, and the interacting with landholder duty provisions.

Whilst such reform is Victorian based, property investors in other states should also be on the lookout for similar reforms, and to see whether other states will follow suite given the introduction of CIPT in Victoria.

There will likely be additional guidance released by the Victorian revenue office. Property investors should engage in early conversations with their tax advisors.